South Dakota’s Small Business Loan Partner

First District Development Company is a certified development company originating SBA 504 loans and other funding options for small businesses across South Dakota. Committed to job growth in our state, we offer financing available at terms that benefit borrowers and lenders.

Current SBA 504 Rates

| 10 Year | 20 Year | 25 Year |

|---|---|---|

| July 2024 | July 2024 | July 2024 |

| 6.49% | 6.28% | 6.21% |

Historical Rates 10 year 20 year 25 year

Borrowers

Affordable Financing For Your Small Business

SBA 504 Loans are designed to fuel small businesses generating new jobs by making financing affordable. Loans are available at a low, fixed rate for terms of 10, 20 or 25 years and require down payments of just 10-20%.

Lenders

Attractive Terms that Work for You and Your Customers

An SBA 504 Loan provides your customer with a long term, low fixed-rate funding option. With a loan-to-value of 50% or less, your collateral risk is reduced and your lending institution retains the first lien position.

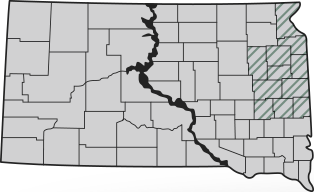

Our Service Area & Programs

Revolving Loan Funds

Small Business Funding Options Versatile Enough

For Your Project

If your financing needs don’t fit the requirements of an SBA 504 loan we have additional options through our Revolving Loan Funds. Each program offers competitive rates to small businesses fueling economic development in South Dakota. While the SBA 504 loan is limited to fixed assets and construction costs, RLF programs can include inventory and working capital financing. Give us a call and we’ll be happy to discuss your goals to determine which small business financing option fits the bill.

FDDC News & Events

Current Events

Watch for Updates

FDDC Quarterly Newsletter: Winter 2022

Black Hills Vinyl

Takes a Turn

Stay Informed On

All Things FDDC

Sign up to receive rates and updates, no junk, just valuable information.