SBA 504 Refinance was created as a long-term fixed-rate option for restructuring existing business debt to assist small businesses at least two years old. Restructuring may be necessary to accommodate growth, take advantage of interest savings or cashing out equity. Take a look at the requirements listed below to determine if you’re eligible. If you have questions about your unique situation, please connect with us.

Eligibilty Requirements

- Original debt incurred not less than 6 months prior to SBA application

- 85% or more of the original use of proceeds of the debt to be refinanced was for commercial real estate, equipment, or other long-term fixed assets

- Original debt incurred for the benefit of the small business

- Small business has been in operation for at least two years

- Business occupies at least 51% of commercial real estate

- Review of payments for past 12 months to determine credit worthiness

- Federally guaranteed debt can be refinanced subject to specific conditions (lender letter and substantial benefit of 10%)

- May consist of one or more commercial loans to be refinanced

- Loan to value of 504 loan and Lender loan at 90% if straight debt refinance

- Loan to value of 504 loan and Lender loan at 85% if debt refinance with cash out for Eligible Business Expenses

- Eligible Business Expenses (EBE) – business operating expenses incurred but not paid at SBA application date or that will become due within 18 months (include salaries, rent, utilities, inventory and other business expenses that are not capital expenditures) – totaling not more than 20% loan to value

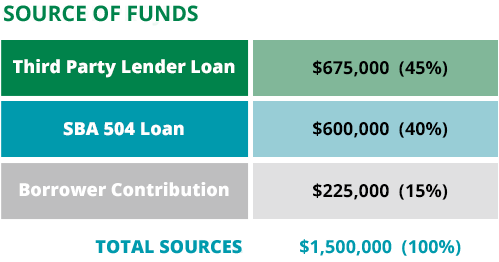

Refinance Financing Structure

In the example below, the existing debt is $1,000,000 and as-is appraised value is $1,500,000.

This example meets SBA requirements for two reasons:

- Total Financing at Loan to Value with EBE of 85% – LTV is $1,275,000 (85%) in this example

- Cash Out for Eligible Business Expenses at 20% LTV – EBE is $275,000 (18.3%) in this example

Preliminary Documentation Required

- Original and current debt information on debt to be refinanced – note, lien instrument, modifications, payment transcript

- Current payoff amount on debt to be refinanced

- Eligible Business Expenses to be paid through the refinance project

- Three most recent years of business and personal tax returns (principals owning 20% or more)

- Current appraisal or approximate value of the assets being refinanced