The SBA 504 Loan program was designed to foster economic growth by making affordable financing available for small businesses. Through FDDC, loans are extended for terms of 10, 20 and 25 years at fixed, below-market interest rates to South Dakota businesses adding full time positions in the state. Loans are also available for businesses meeting public policy goals which include rural development, woman, minority or veteran ownership, expansion of exports, energy efficiency, labor surplus area or business district revitalization.

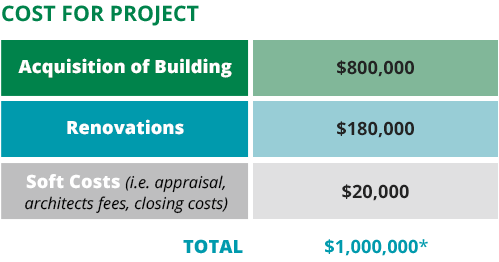

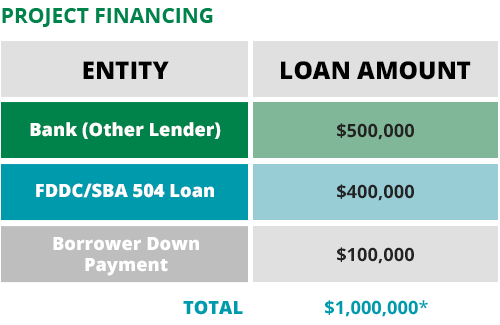

Example of Financing on a Typical $1 Million Project

* An additional 5% down payment is required for certain projects like special purpose buildings (i.e. car wash, hotel) or for start up businesses. For both a new business and a special purpose building, the down payment is 20%.

- Eligible Uses – an SBA 504 loan can be used for land, facility or equipment purchases as well as construction or renovation costs.

- Eligible Businesses – any new or expanding for-profit South Dakota business is eligible, though it must have a net worth of $15 million or less and an average net income of $5 million or less in the last two years.

- Maximum Amount – up to 40% of a project can be financed for $25,000 – $5 million and small manufacturers or energy reduction projects are eligible for $5.5 million in SBA financing.

- Economic Development Criteria – one full time position is required for every $75,000 SBA dollars loaned, for small manufacturers, $120,000 is available for each full time position added. Funding is also available for businesses meeting public policy goals, which include rural development, woman, minority or veteran ownership, expansion of exports, energy efficiency, labor surplus area, business district revitalization, or opportunity zone.

- Terms – loans are available for 10, 20 and 25 years at a fixed rate that’s typically below market interest rates. Borrowers are required to provide 10-20% cash or land equity.

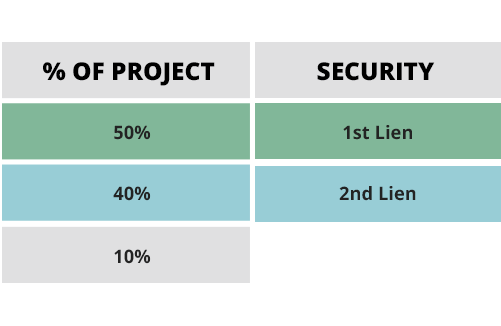

- Loan Structure – 10-20% cash equity from borrower, 30-40% financing from FDDC and the remaining 50% from a private lender.

- Fees – 504 processing fees total approximately 3% of the 504 portion of the loan and are financed with the loan. Monthly servicing fees total approximately 1.1% of the 504 loan balance and are included in the full term effective interest rate.

- Collateral – this may include a mortgage on the land and building being financed, liens on machinery and equipment, lease assignments, life insurance assignments and/or personal guarantees. The participating lender will receive the first lien position.

- Service Area – businesses must reside in the state of South Dakota.

Borrower Benefits

- Low, fixed rates – the competitive SBA 504 rates help small businesses maximize cash flow and accurately predict future capital needs.

- Low down payment – financing available for up to 90 percent of project costs allowing businesses to conserve working capital.

- Long term financing –20 or 25 year, fully amortized financing enables a small business owner to pay for a facility over the long term and avoid balloon provisions.

- Own your business, own your life – owners can pay on their SBA 504 loan rather than throw money away at rent, an investment in their personal and business financial future.

Lender Benefits

- Opens lending options – offering SBA 504 loans to eligible small businesses opens the door for lending relationships where legal lending limits or industry exposure may have otherwise prevented.

- Minimized risk – with a loan-to-value of 50% or less, your collateral risk is reduced.

- Senior lien position – as part of the SBA 504 loan program, the FDDC forfeits the first lien position to the participating lender, and it can be sold on the secondary market.

Application Process

- Initial Interview – the SBA 504 loan approval process begins with a meeting between the borrower and/or lender as well as a FDDC representative to review the details of the project.

- Application Submission – Based on the project parameters, FDDC will outline the required documentation and forms that need to be completed by the borrower.

- FDDC Board Approval – once all application components are received, FDDC will perform a review and present the loan request to the FDDC Board of Directors for approval. Loan approval is typically received within 1-2 weeks of application.

- SBA Loan Approval – once approved by the FDDC Board of Directors, loans are submitted to SBA’s central processing center for final approval. Upon approval, FDDC will review the Loan Authorization with the borrower and a written acceptance of the Authorization will be obtained from the borrower.

- Closing – a closing will be scheduled following the purchase of all assets or the completion of all project construction, which will include both the SBA 504 Loan and the participating lender loan.

- Funding – funding typically occurs 45-60 days following the loan closing. Funds are wire transferred directly to the participating lender, reducing the interim loan amount to the agreed lender portion. The rate on the SBA 504 loan is established at the time of funding.

If you have questions or would like to learn more about financing options for your small business, please give us a call at 605-882-5115.