It’s as easy as 1 – 2 – 3…

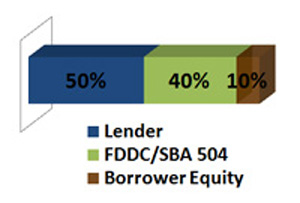

- A bank or other private lender typically finances 50% of the project cost and takes a first lien position on the assets financed. This lender provides a commercial loan at current market rates and fees for their share of the project. They also provide the construction or interim loan that is paid off from the proceeds of the SBA 504 loan.

- First District Development Company finances up to 40% of the project cost with the SBA 504 loan and takes a second lien position.

- The small business owner provides a down payment that can be as low as 10%*.

*An additional 5% down payment is required for projects involving special purpose real estate or for new businesses/no experience. If thewner’s equity is increased, the FDDC/SBA 504 loan is reduced.