Don’t worry, it’s not rocket science – structuring an SBA 504 project is as easy as 1-2-3!

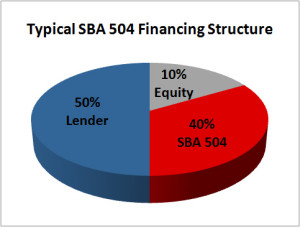

1. Financial Institution enjoys first lien position on 50% of value.

1. Financial Institution enjoys first lien position on 50% of value.

2. FDDC / SBA 504 loan is a direct loan to the borrower with a second lien position.

3. Borrower must inject a minimum of 10% cash or existing equity in project real estate. If project involves a single purpose property or if the owner is new to the business, an additional 5% equity is required. If both situations apply, borrower is required to inject an additional 10% of equity, for a total of 20%.

To determine the exact structure of your 504 project call or email First District Development Company!