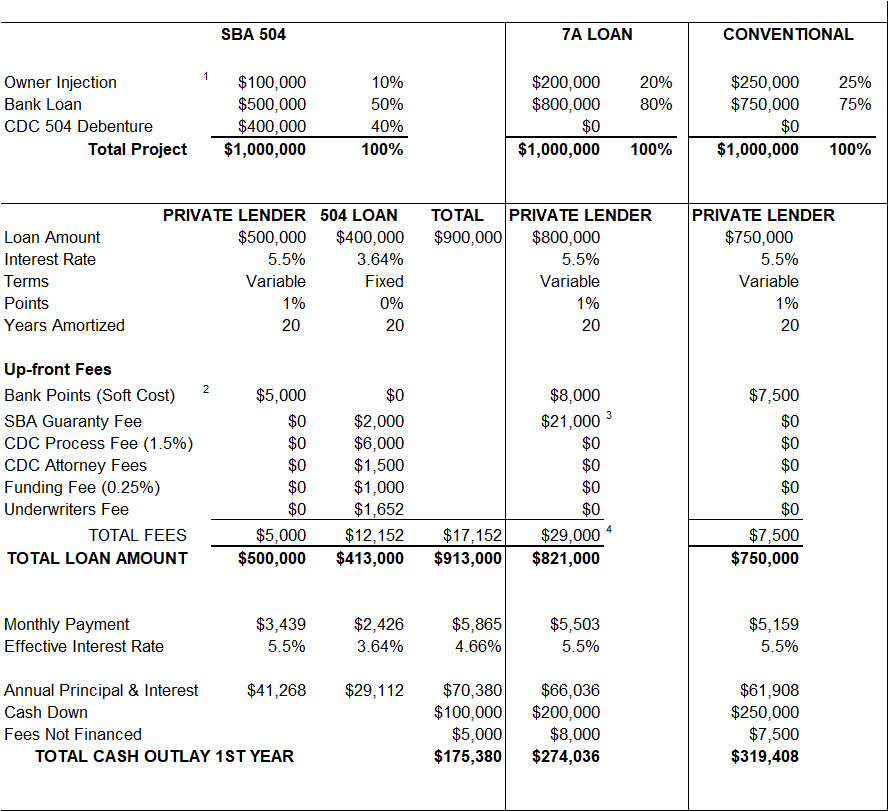

The table below outlines a comparison between financing options available to small business clients. While SBA financing traditionally involves fees, because of the long term, low fixed rate of the SBA 504 loan, small businesses can save over a period of time. Additionally, the initial investment for the small business owner is reduced because of the low equity requirement. Bottom line…the small business owner saves valuable cash by utilizing the SBA 504 loan, and the larger the project being financed, the more they will save.

1 Owner’s Injection varies based on borrower’s experience and type of business, however it is typically higher when there is no SBA involvement.

2 Points on the bank’s term loan can be charged, but cannot be financed in the 504 project.

3 This fee is based on a loan amount of $800,000 with a 75% SBA Guaranty or $600,000. The fee percentage for this size of guaranty is 3.5% or $21,000.

4 This number does not take into consideration the on-going Lender Servicing Fee that is paid annually by the bank, which is 0.55 percent of the guaranty balances.