SBA has been processing the now permanent SBA 504 Debt Refinance applications for over five months. A few changes have been made recently to make refinance easier for small business owners to refinance their owner occupied commercial real estate debt…

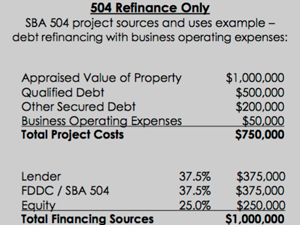

- The maximum refinance loan-to-value for loans where cash is taken out for business expenses has been increased from 75% to 85%.

- Changes have been made that make it less restrictive when it comes to ownership changes for eligible companies.

- Appraisals can now be one year old instead of just 6 months.

SBA has implemented these changes after reviewing industry comments as the Debt Refinance program became permanent in 2016.

Here is a summary of the main requirements to refinance debt under the 504 Debt Refinancing Program:

- The commercial loan (qualified debt) to be refinanced was incurred not less than 2 years prior to the date of application.

- Substantially all (85% or more) of the proceeds of the commercial loan (qualified debt) being refinanced were used to acquire eligible fixed assets.

- Other secured debt is eligible to be refinanced along with qualified debt, but no new debt (expansion costs) are allowed.

- The loan (or loans) being refinanced must not have any late payments in the previous 12 months and evidence must be provided.

- Applicant must meet all other eligibility requirements of the SBA 504 program.

- Existing government backed loans, such as 504s, 7as, or USDA loans cannot be refinanced under this new program.

- Third Party Loans which are part of an existing 504 project cannot be refinanced under this new program.

- For refinance-only projects the maximum loan-to-value is 90%.

- Cash-out refinancing is permitted to cover most eligible business operating expenses.

- Business operating expenses include salaries, rent, utilities, inventory, or other business obligations incurred but not paid or that will become due in the next 18 months.

- When business operating expenses are included, the maximum loan-to-value is 85% and operating expenses cannot exceed 25% of the appraised value.

Contact FDDC for more details on the SBA 504 Debt Refinance program at 605-882-5115.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||