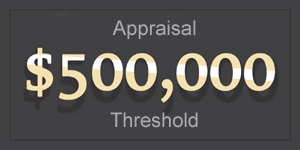

Congress recently passed the Small Business ACE Act which raises the appraisal threshold for 504 loans secured by commercial real estate to match the federal banking regulator appraisal threshold amount for commercial real estate transactions.

Previously, SBA required a real estate appraisal if the estimated value of the 504 project property was over $250,000. The new law raises the SBA 504 appraisal threshold to match the federal banking regulator threshold, which is currently $500,000.

When the Project Property is $500,000 or less, an appraisal will be required under the following circumstances:

a) Equity in land owned for 2 years or more is used as part of the Borrower’s contribution;

b) The real estate is Third Party Lender’s OREO;

c) If the loan finances a transaction involving parties with a close relationship;

d) The seller of the property is carrying back a loan that is part of the Borrower’s contribution;

e) If SBA or the CDC concludes that an appraisal is necessary to appropriately evaluate creditworthiness.