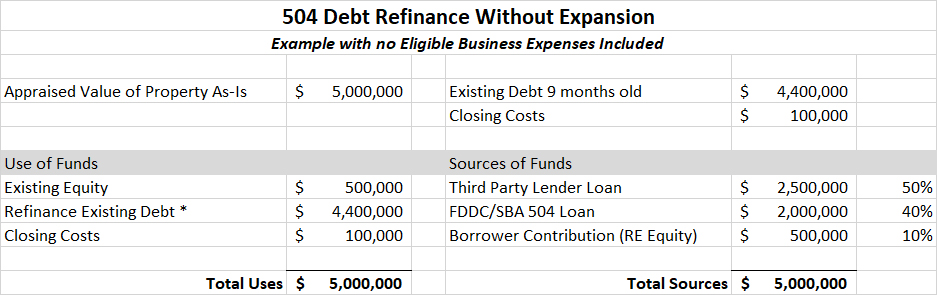

Examples of 504 Refinance projects below incorporate the new rules SBA recently published that are effective immediately. A reminder of the changes that were released follow the examples. Contact FDDC for assistance with structuring your specific 504 Refinance project.

*Existing debt cannot exceed 100% of new costs in the 504 project. Remaining amount can be added to the Third Party Lender Loan (Final TPL Loan in this example = $2,700,000.)

*On the debt to be refinanced substantially all (85% or more) of the proceeds of the original existing debt was used to acquire eligible fixed assets and the remaining amount was incurred for the benefit of the small business. Debt that is in place 6 months or more can now be refinanced.

*Government debt is now eligible to be refinanced.

**SBA requires a 20% cap on Eligible Business Expenses and a maximum loan to value of 85% for projects involving Eligible Business Expenses.

The conditions and requirements for refinancing debt in the 504 Loan Program are revised as follows –

For 504 debt refinancing with expansion –

1. The amount of the existing indebtedness that may be refinanced as part of a 504 Project has increased from not more than 50% to not more than 100% of the project costs of the expansion.

For 504 debt refinancing without expansion –

1. Eliminates the condition that the program is only available when the 504 Loan Program is at zero subsidy.

2. Eliminates the cap that restricted Certified Development Companies (CDC) from processing new refinance loans that exceed 50% of prior year dollar volume.

3. Reinstates an alternate job retention standard – all existing jobs measured on a full time equivalent basis can be counted as jobs retained by the refinancing project.

4. Qualified Debt must be at least 6 months old before the SBA application date to be eligible for refinance, reduced from 2 years old.

5. Allows the refinance of existing government guaranteed debt – existing SBA policies related to refinancing existing 504 or 7a loans will apply, including –

- For an existing 504 loan, either both the Third Party Loan and the 504 loan must be refinanced, or the Third Party Loan must be paid in full.

- For an existing 7a loan, the CDC must verify in writing that the present lender is either unwilling or unable to modify the current payment schedule. In the case of same institution debt, if the Third Party Lender is the 7a lender, the loan will be eligible for 504 refinancing only if the lender is unable to modify the terms of the existing loan because a secondary market investor will not agree to modified terms.

- The refinancing of any federally-guaranteed debt will provide a “substantial benefit” to the borrower – minimum 10% savings on the new installment amount attributable to the debt being refinanced.

6. Eliminates the requirement that the borrower must be current on all payments due for not less than 1 year before the SBA application date – in accordance with prudent lending standards, SBA expects the CDC to consider whether the applicant is current on all payments due and the applicant’s history of delinquency in its credit analysis.

All other existing policies and procedures for 504 debt refinancing with and without expansion continue to apply unless specifically modified by the Interim Final Rule.

Specifically, in the 504 debt refinancing without expansion program these requirements remain in place –

- Substantially all (85% or more) of the proceeds of the original existing debt was used to acquire eligible fixed assets and the remaining amount was incurred for the benefit of the small business.

- May consist of one or more loans as long as each loan meets the requirements of Qualified Debt.

- Applicant business must be in operation for at least 2 years.

- The 20% cap on eligible business expenses and the maximum loan to value (85%) for projects involving eligible business expenses continue to apply.

- Eligible business expenses include expenses incurred but not paid or that will become due within 18 months of SBA application date, such as salaries, rent, utilities, inventory, etc.