With SBA 504 rates dipping to new lows, your clients may benefit by locking in a fixed rate on existing commercial debt. Remember SBA 504 Debt Refinance is a permanent part of the program and pertains whether you have new or existing clients with qualified debt at least two years old. It is also eligible to take cash out to cover business operating expenses. Guidelines vary of 504 Refinance with or without expansion – see the requirements below.

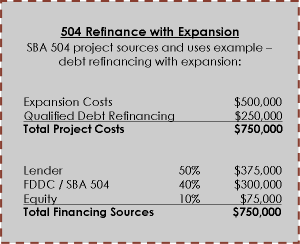

SBA 504 Refinance with Expansion

- Existing debt of up to 50% of the expansion costs (construction, professional fees, interim interest) can be included in the 504 project

- Business must be in operation at least 1 year

- Existing debt has to be for fixed assets or only use portion of debt that was for fixed assets

- Business must be current on payments for 1 year

- Existing debt can be less than 2 years old

- Can refinance SBA 504/SBA 7a/Third Party Lender Loans made with an SBA 504 project

- Refinance must provide a substantial benefit to the business – a savings of at least 10% or refinancing a balloon payment is automatically considered a substantial benefit

- Refinance must provide better terms or interest rate (Examples: longer maturity, lower interest rate, improved collateral conditions, less restrictive loan covenants)

- Equity in land & building can be used to meet 504 equity requirements

- Excess debt that exceeds 50% of the cost of expansion can be consolidated into the Third Party Lender Loan as long as the debt was secured by the project property

SBA 504 Debt Refinancing Program (Refinance Only)

- Only existing debt (no expansion costs) can be included in the 504 project

- Qualified debt must be at least 2 years old and used to acquire an eligible fixed asset

- Business must be current on payments for 1 year

- Cannot refinance SBA 504/SBA 7a/USDA or Private Lender Loans made with SBA 504

- Refinance only projects maximum loan-to-value is 90%

- Cash-out refinance is permitted to cover most eligible business operating expenses

- Business operating expenses include salaries, rent, utilities, inventory, or other business obligations incurred but not paid or will become due in next 18 months

- When business operating expenses are included, the maximum loan-to-value is 85% and operating expenses cannot exceed 20% of value

- Must meet all other eligibility requirements of SBA 504 program

For more details, contact First District to discuss your refinance project and its SBA 504 eligibility…605-882-5115.